CorpGov and FinOper

Corporate governance and financial operations — Discuss the way of do long enterprises bigger and stronger

— Chen Xiliang

Enterprise is the enterprise in the United States. — Coolidge

The purpose of business is to create happiness, not just the accumulation of wealth. -- b. c. Forbes

In the 19th century is the century of entrepreneurs, the 20th century is the century of management, the 21st century is the century of corporate governance. - anonymous

In modern society, the corporate entity is one of the most important subject. It can meet the demand of the market, provide jobs, create wealth and value, affect the various stakeholders - customers, employees, suppliers, or society as a whole. Since the company is so important that it's thriving, the way of business, how to do bigger and stronger, for a long time, became the subject of attention in modern society.

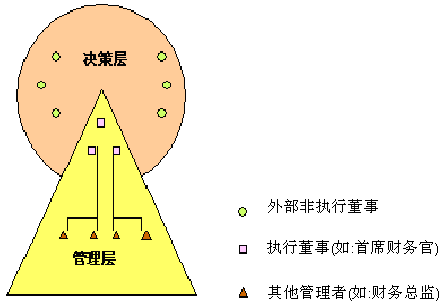

Corporate governance, its essence is the governance structure and governance mechanism. Governance structure, it is to point to in the company legal person property entrusted, the framework of agency system, regulate the responsibility, right, the relationship between different government office of a kind of institutional arrangement, which includes authority - the shareholders' committee, decision-making body, the board of directors, watchdog, the board of supervisors and manager team actuators, etc. These institutions are responsibilities clear, independent each other, checks and balances, coordinate with each other. Governance mechanism, in his strategy as the core, in the company's target as a starting point, in decision-making, execution and supervision for the process, on the basis of trust, on the basis of performance, pay attention to the internal governance of collaboration model professional division of labor.

Financial operation, the core of corporate governance is a dynamic, around the value goal of enterprise, in the competition of the market mechanism, the interaction and balance through the external governance and internal governance, property rights and competition, the interaction and balance, benefit and safety of the interaction and balance, interaction and balance of the asset value maintained and added, ultimately achieve the goal of enterprise and the environment of dynamic balance. This would require the synergy of financial strategy and corporate strategy, corporate goals and financial goals of coordination, financial system and the company level matching, financial operation and financial management skills, and financial ability to create wealth. The following will be taken from the several aspects discusses --

A, the purpose of corporate governance is to achieve enterprise economic and efficient

The company goal is to make shareholders, employees, creditors, government and the maximization of the value of customers and other stakeholders. Financial goal is to achieve the maximization of enterprise value. Includes both the value of the enterprise market value (market value represented by listed companies and unlisted companies to establish and form), also reflected in the company's social responsibility, especially in the process of social harmony, the company is not only to make money, or material (decaying capitalism), and more should focus on promoting the process of human society, continuously meet the needs of the people's material and spiritual culture.

If the company goal is big, in general, the direction of the macro, financial goal is through a series of accounting, economics, finance, taxation, etc., according to the law of compiling form the direction of movement. Installment according to accounting principle, under the general direction the company target, determine the relevant economic indicators and data in stages. In this sense, the financial goals is a phased implementation and to achieve company goals, work in the real practice, however, is a dynamic process, there is a dynamic and static of the philosophy of relationship, is the mutual tolerance and interactive woven.

Corporate governance and financial operations, tell from the target, is under the condition of the company's existing objective, according to the shareholders, the board of directors, managers, and these decisions of the board of supervisors, execution, supervision, etc, on the strategic direction of a standard.

Financial operation starting from the investment of shareholders, to entrust the board to achieve financial value and contribution to the society, to make wise decisions, and monitors the execution of decisions, policies, the final evaluation of the implementation of rewards and punishments. Managers and executives responsible for operating assets, resources, and build the value of cultural concept, the implementation of company management, risk management, internal control, performance, construction of cultural values is supposed to do. These jobs are continuing, endless, the changing conditions in the face of internal and external environment, to do to reach their goals and the enterprise financial goals, financial strategy, the requirements of the company objectives, strategies and results. Are flesh and blood, therefore, on how to build and execute company goals, financial goals, the manager and other executives and policymakers mechanism of incentive and constraint and system safe and not lose efficiency, is the core issue of governance and operation. Figure 1:

Second, the financial strategy in line with company strategy synergy

Company's strategy including the profit pattern, the direction of development, and its positioning in the market. And how financial strategy on the existing platform integration of operational resources, to achieve the company goal --

1, coordination;

2, the financial strategy must be from a financial professional to examine and assess the company's strategy;

3, revise, supplement and improve the company's strategy and put forward to meet the needs of the company's strategy and market.

Corporate strategy and financial strategy is not only a thing, that is the same, and have its different, including macro and micro, planning, action, etc. In this sense, the goal is consistent, and taken by the method and level of denotation and connotation is different.

Corporate governance and financial operation included in the practical work, some of the company's two policies, or collaborative enough, complementary. System, order, order, and did not do the best process. According to modern corporate governance structure and mechanism, it will be achieved through the external governance and internal governance to achieve the balance of property rights and competition, and to achieve the balance of efficiency and safety. Security from corporate governance, from financial operation efficiency. Therefore, corporate governance and financial operation is successively, and the same starting point of the problem. If the corporate governance and corporate strategy is the "bow", financial operation is "arrow", the goal of enterprise is the target, have "bow" or "arrow" not, "arrow" no miss "bow" goal. Figure 2:

Three is the core of corporate governance, financial system elements

Inside corporate governance structure of directors must be independent directors, especially financial technocrat who director in the board. In decision-making executive level, and required set CFO (chief financial officer), CEO (chief operating officer), at the same time at the helm of the company goods and administration. Chief financial officer of the company's financial and subordinate departments, such as the financial manager, the implementation of control or the specified delegate, to give recommendations. Thus it can be seen that management and financial operations is always inseparable.

The financial system is usually divided into three types:

1, the chief financial officer (CFO). Responsible to the shareholders, and form a complete set of system of chief executive officer (CEO). Under this system, the finance director is entrusted by shareholders, run and monitor the company's finances, give him greater responsibility and higher platform, and asked him to in the enterprise value creation, security and benefit balance, excellent function and the role of the policy target.

2, the chief accountant. Assistant general manager responsibility system under the financial and positioning for accounting technocrats, responsible to the general manager and the board of directors. The chief accountant nominated by the general manager and the board of directors election and appointment. Belongs to one of the leaders of enterprise managers. This financial system is followed in the 50 s of the Soviet system, both in the enterprise play the role of a technocrat, and put his position for the corporate governance system inside the middle of the class. The above bearing, although also is the essential means to general manager and the board of directors, is refers to the financial department under the duty and financial management. Its function and role, responsibility, right and lower than the previous chief financial system. Because the chief financial officer, CFO, CEO and chief, both of which are not primary and secondary, is different, the work of their responsible for. And the chief accountant system, is the executive financial assistant, also employed by the board of directors, responsible to the board, so it is of dual leadership.

3, director of finance. Namely, head of the finance department, directly responsible to the boss, focused on the role of financial supervision and evaluation. Located in financial high-level technocrats, in the role of the enterprise has certain limitations. Figure 3:

Fourth, optimizing the allocation of resources

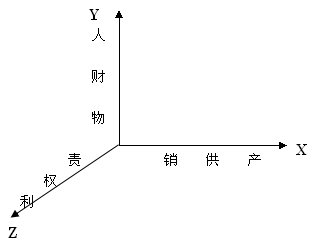

The bow of financial operating said. If corporate governance is the bow, the financial operation is the arrow, enterprise target is the bull 's-eye. As I said, "bow" drive "arrow" to the bull 's-eye "target" movement. Movement will be affected by the wind, such as climate, magnetic field and the function. Target has the bull 's-eye, eight, nine, ten. Corporate governance and financial operations, its essence is with archery. In this respect, governance is different from management, management is the control, good corporate governance is a control. There is an old saying called asking management for benefit, some of the founders of golden understand three, is the enterprise management of nine words: configuration "people, goods, content resources," the relationship between "responsibility, right and benefit" and a "pin, supply and production value. Figure 4:

1, people, goods, including information resources, is one of the modern enterprise measure value standard. Operation of these resources to build and ability but also the standard of the difference between good and great. This includes the enterprise system arrangement, culture construction, incentive constraint mechanism, and entrepreneur, the directors of the thinking, ideas and vision. Content is dead, people are living. Between people and objects, goods have the effect of a medium and transmission, and as governance and finance.

Integration of people, goods, content resources, including the inside and outside. Modern popular and effective such as outsourcing, etc. Outsourcing is a market demand for rapid response. Investors do not do research and development, such as its core problem is to play a professional advantage, whether it be a shoeshine, beauty salon, chip research and development, according to the political economy of socialization, specialization division of labor, their energy and resources, time, etc., to invest in the best job, to produce the best effect, create more spiritual and material that is financial.

2, responsibility, right and benefit system. The responsibility, right, is the company system construction, profit distribution, constraints, up the stairs. The responsibility, right, the Chinese management, European, American and Japanese management is company is differ in thousands ways under different cultural background.

Spot gold founder believes that there is a method, the principle, structure and the distribution of the proportion question. This is because China's governance and management, balance is the key. And balance refers to the person's emotion management, is a top priority. And the emotional management is subject to its satisfaction and perception. But on the other hand, are not able to fully use such a theory to planning, design and operation enterprises. This is between emotion and reason, which is now method is generally used to private enterprises, state-owned enterprises, more reasonable, a little less rigid rules of the game - method.

Market economy is legal economy, credit economy. No method of economy and corporate, is far from market and competition advantage. Chinese companies do not, the crux of the hard for a long time. So some gold founder thinks, in France, reason and emotion, "law" (50%), "" (30%)," the sentiment "accounted for 20%. Including days, tao, force, sex, people, and that is usually what we call social qualities, values and we advocate a harmonious society of "eight honors, eight disgraces" etc.

3, about the pin, and the value chain of production, supply, corporate earnings process is the practice of traditional production, supply and sales, is now pin, production, supply. Words are not bad, process order change, also is the production from the planned economy era, do inventory products, instead, market-oriented, manufacturing-according-to-sale, order to production, accelerate the turnover of funds and use efficiency, reduce business risk.

In terms of value chain, different industries have different business processes, but sales and production, supply in manufacturing enterprises, circulation enterprises and service industry is inseparable from the business process, and the value of the implicit process conduction and value-added process. In early years, general motors entered China, dell computer zero inventory tailored production mode in China pioneered the concept of "market" and the operation of the values, replaced the traditional thinking and mode of business. In the traditional evaluation index in the process of state-owned enterprises, there is a sales, is the production of products sold into a commodity that the ratio of the two data, namely ratios, it can be seen in the former production, pin in the back. Now the enterprise operation and the operation of the computer information technology, all removed the previous operation mode, the new management idea and operation mode, reduce the risk of the enterprise inventory, the account receivable credit risk of bad loans, and enterprise capital rationing financial structure and cash flow risk. More importantly, the value chain in the process of rapid conduction, profit and value increase. In car production and sales, for example, the market need price positioning 200000 models, when the market to win orders, in the shortest possible time to design, arrange production, procurement of raw materials production, to complete a cycle, production and sales and collection cycle. Sales and production, supply the biggest harvest, is shorten the cycle of operation (production, sales, money collecting process of such a cycle).

Fifth, financial wealth creation

1, enterprise business process and restructure. Enterprise how to do? Is a production, supply and sales or marketing, production, supply? On the one hand is depends on the value of mining, from a professional financial cost management control is concerned, the market gap (profit) in where? Research and looking for you. On the other hand is a corporate governance from the perspective of the direction of large, sales, production, supply, replaced by the decisions of the traditional patterns of the production, supply and sale is the science of decision making, optimization and improvement. A, it is a profit objective existence of the gap, the financial with professional technology and eyes to find, discover and create. B, from the subjective to the enterprise as well as the production and business operation, financial planning and arrangement, the process optimal, the cost of the province. This is called to the management efficiency, benefit through management and enterprise value. Generally think it is intangible, but in the expert's opinion, there is an old saying is lively and vividly on the interpretation, so it is with "skilled and magical craftsmanship".

2, make financial wealth creation. From system to system, said before the system arrangement, the position with chief financial officer, chief accountant system, financial supervision, the enterprise how to set the financial system, is the connotation of the word "let" and implementation. Set too high, the operation of the space is large. Of course it also depends on the matching of financial professionals itself accomplishment, experience and ability. From the goal of governance, financial goals, corporate strategy to the financial strategy, the bull 's-eye and bows and arrows and other professional technology to create wealth, namely, corporate finance, it is possible to become the enterprise value creation of pilot and elites, excellent, chief financial officer is excellent entrepreneur.

3, how will the things on the paper surface, namely the strategy, goal, planning, plans, and the main data index. From these in advance forecast and analysis to the budget to finalize, throughout the operation of the beforehand matter, afterwards. Tell from the tense, the future is to do a good job in planning, the present tense is well execution and implementation, the past is for report and supervision. Let the financial to create wealth, from the development of capitalism, from the operation of a successful business, there are a lot of convincing case. Anyone enterprise operation is guess. From the Angle of management, will argue for and focus on the management function and benefit; From the perspective of governance may focus on the structure and mechanism of importance; From the perspective of financial operations and corporate finance, as said before, with the objective regularity, scientific, technical and operability, and uncertainty.

To sum up, the modern corporate governance, governance and conduction of financial management, supervision, evaluation and reporting, like sailing in the sailing, the power of the ship and wind is intangible and tangible epic. Ship and wind, as well as bow and arrow and rake, implication and reveals do bigger and stronger, do long business.

With the board of directors as the core of corporate governance, enterprise value maximization as the goal of financial operations, persistent to keep the balance of efficiency and security. Only in the case of sure, security, fully operational enterprise resources and to maximize the efficiency and effectiveness of, can't ignore the existing environment, resource, system, system speed and excessive pursuit of scale, comprehensive operation, sure can put the enterprise from the general to outstanding, from excellent to create excellence.

Corporate governance and financial operations such as building a house - frame, floor and wall, its robustness, persistence, anti-seismic capability, to sustain in the planning, design, construction and acceptance standard is scientific. And like a ship in the sea, it is junk, or ships, or aircraft carrier, will decide its voyage rhythm, speed, and can reach the destination. Figure 5: